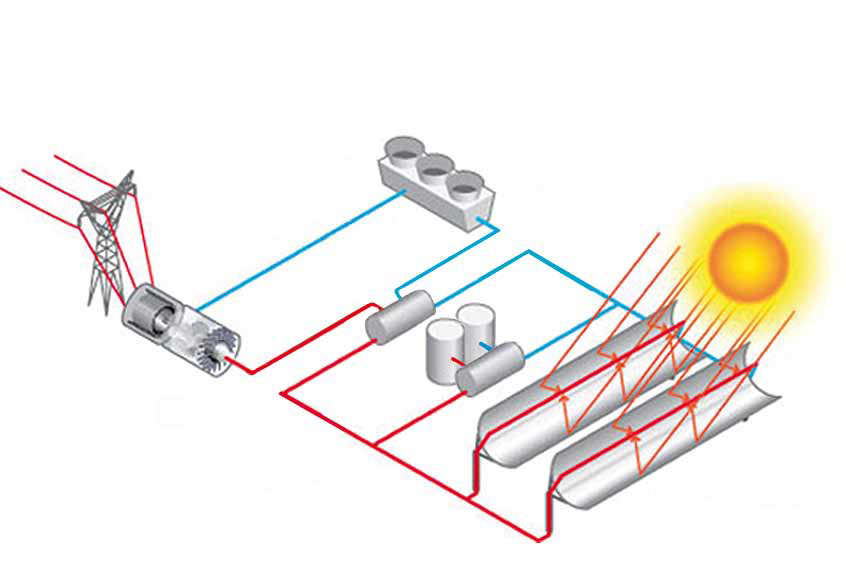

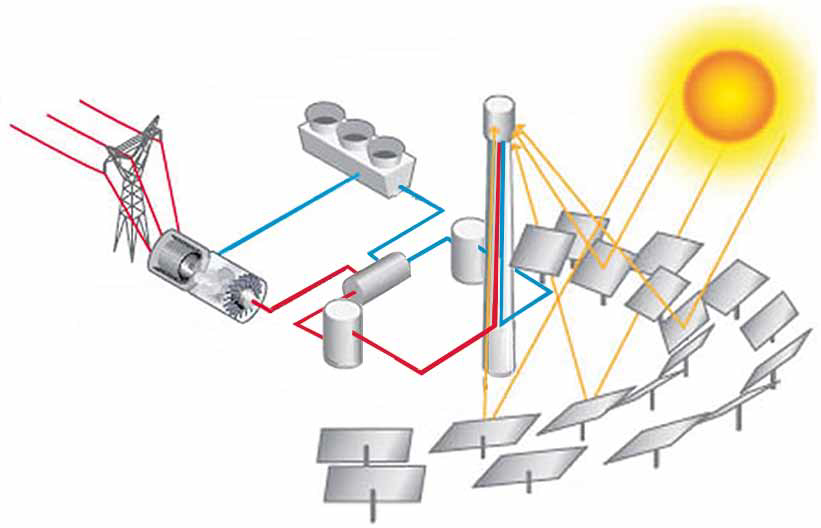

Solar Thermal Electricity (STE), also known as Concentrating Solar Power (CSP), is a technology that produces electricity by using mirrors to concentrate direct-beam solar irradiance to heat a liquid, solid or gas that is then used in a down- stream process for electricity generation.

Generation of bulk solar thermal electricity from CSP plants is one of the technologies best suited to mitigating climate change in an affordable way by reducing the consumption of fossil fuels.

Unlike photovoltaic technology, STE offers significant advantages from a system perspective, thanks to its built-in thermal storage capabilities. Solar thermal power plants can operate either by storing heat or in combination with fossil fuel power plants, providing firm and dispatchable power available at the request of power grid operators, especially when demand peaks in the late afternoon, in the evening or early morning, or even when the sun isn’t shining.

No fuels required! Just the solar power from the SUN!

Almost carbon-free (except for production and transportation)

Use of thermal storage can better match supply with demand

Operating costs are low

Can serve as a drop-in replacement for conventional fuels to make steam to produce electricity

Scalable to the 100MW+, supply on demand and high efficiency.

Learn more

Learn more

Solar thermal power requires direct sunlight, called ‘beam radiation’ or Direct Normal Irradiation (DNI). This is the sunlight which is not deviated by clouds, fumes or dust in the atmosphere and that reaches the earth’s surface in parallel beams for concentration. Suit- able sites must get a lot of this direct sun – at least 2,000 kWh of sunlight radiation per square metre annually. The best sites receive more than 2,800 kWh/m2/year.

Typical regions for concentrating solar are those that lack atmospheric humidity, dust and fumes. They include steppes, bush, savannas, semi-deserts and true deserts, ideally located within 40 degrees of latitude north or south. The most promising areas of the world include the south- western United States, Central and South America, North and Southern Africa, the Mediterranean countries of Europe, the Near and Middle East, Iran and the desert plains of India, Pakistan, the former Soviet Union, China and Australia.

In these regions, one square kilometre of land can generate as much as 100–130 GWh of solar electricity per year using solar thermal technology. This corresponds to the power produced by a 50 MW conventional coal- or gas-fired mid- load power plant. Over the total life cycle of a solar thermal power system, its output would be equivalent to the energy contained in more than5 million barrels of oil.

Like conventional power plants, solar thermal power plants need cooling at the so-called “cold” end of the steam turbine cycle. This can be achieved through evaporative (wet) cooling where water is available or through dry cooling (with air), both of which are conventional technologies. Dry cooling requires higher investment and eventually leads to 5%–10% higher costs compared to wet cooling. Hybrid cooling options exist that can optimise performance for the site conditions and are under further development.

Water consumption for use in wet cooling in the Spanish plants has proven to be half of the water needs per hectare, as compared with the consumption of agricultural crops, like corn or cotton in Andalucia, Spain. Also, STE uses 200 times less water than a coal power plant to produce the same amount of electricity, according to IRENA’s soon-to-be-released regional report.

The huge solar power potential in the “Sun Belt” regions of the world often far exceeds local demand. This creates the potential for excess solar electricity to be exported to regions with a high demand for power but a less favourable solar irradiance. In particular, southern European and North African countries could harvest the sun for export to northern European countries in the medium and long-term. Of course, for any new development, local demand must be met first.

A range of technologies are used to concentrate and collect sunlight and to turn it into medium- to high temperature heat. This heat is then used to create electricity in a conventional way, i.e., run a turbine. Solar heat collected during the day can also be stored in liquid or solid media such as molten salts, steam, ceramics, concrete or phase-changing salt mixtures. At night, the heat can also be extracted from the storage medium to keep the turbine running. Solar thermal power plants work well to supply the summer peak loads in regions with significant cooling demand, such as Spain and California. With thermal energy storage systems, they operate longer and even provide baseload power. For example, in Chile the 110 MW Atacama STE plant with 17.5 hours of thermal storage, is capable of providing clean electricity 24 hours a day every day of the year. There are four main types of commercial STE technologies: parabolic troughs and linear Fresnel systems, which are line concentrating, and central receivers and parabolic dishes which are point concentrating central receiver systems, also known as solar towers. Dishes with Stirling motors are not an appropriate technology for utility scale applications and therefore we will only refer to solar towers when talking about central receiver systems.

Since the last update on STE technologies in 2009, on-going progress has been made in the use of STE technologies outside of the electricity sector, namely solar fuels, process heat and desalination. Advances have also been made in storage systems for this technology.

A full list of the plants operating, in construction can be found in this map.

Dispatchability is the ability of a power producing facility to provide electricity on demand. Dispatchable power plants, for example, can be turned on and off and adjust their power output on demand. Conventional power stations, like fossil fuel plants, are dispatchable but produce, among other things, CO2 emissions. STE plants, however, which produce electricity in a manner similar to conventional power stations, i.e., by driving a steam turbine, are also dispatchable.

Dispatchability is one of the characteristics that makes STE a favoured option among other renewable energy technologies. All solar thermal power plants can store heat energy for short periods of time and thus have a “buffering” capacity that allows them to smooth electricity production considerably and eliminates the short-time variations that non-dispatchable technologies exhibit during cloudy days.

What’s more, thanks to thermal storage systems and the possibility of hybridisation,4 solar thermal power plants can follow the demand curve with high capacity factors delivering electricity reliably and according to plan. Thermal storage systems also allow STE to provide power in the absence of direct solar radiation, such that periods of solar generation and demand need not coincide.

For this case, the solar thermal power plant supplies electricity when needed to help meet peak demand.

Firmness and dispatchability are the main benefits of STE. STE and other renewable energy technologies, such as PV and wind, can thus be combined in an energy system to balance supply. In this way, STE can replace fossil fuel power plants and contribute to a 100% renewable energy supply as one of the renewable technologies capable of following the demand curve and ensuring a 24/7 secure supply. STE plants can also contribute to the stability of the system, i.e., maintaining voltage and frequency within required ranges, and allowing further penetration and integration of intermittent sources without the need for fossil fuel back-up.

In the field of energy, the commitment by the Juncker Commission in 2014 to become “Nr. 1 in RES” has not been changed. However, it was never backed by any national commitments…

[…]

Technology leadership currently held by Europeans for STE is to defend not only for the benefit of Europeans but also understood as the firm European contribution to achieve a more sustainable development for all countries for the world. This implies already today a strong collaboration with many other countries endeavouring together to blend their respective assets for a common goal.

“We need to strengthen the share of renewable energies on our continent. This is not only a matter of a responsible climate change policy. It is, at the same time, an industrial policy imperative if we still want to have affordable energy at our disposal in the medium term. I therefore want Europe’s Energy Union to become the world number one in renewable energies.”

“An ambitious climate policy is integral to creating the Energy Union. Actions include the EU Emissions Trading System (EU ETS), strong but fair national targets for sectors outside the ETS to cut greenhouse gas emissions, a roadmap towards low-emission mobility and an energy policy which makes the EU world leader in renewables”.

Technology leadership depends on early market penetration, clear strategy and better resources than those of competitors.

Being a (market) leader implies meeting at least one of the following conditions:

Technology leading companies must constantly monitor their environment so to defend their leadership (unless they happen to act in a legal monopoly position, which is not likely to be the case any longer). To do this, companies can opt for 2 strategies:

No single STE power plant has been built so far worldwide without using European technology…

[…]

STE is the only one or among the few technology sectors where European companies hold technology leadership due to a STE deployment program launched in Spain back in 2004.

This deployment initiative taken by the Spanish government led to the construction of some 50 STE power plants in Spain – a wise political decision that indeed fulfilled at that time the conditions for achieving leadership in a new renewable energy technology.

Spain and the other countries such as Germany, Italy, Denmark, France, etc. that participated in this wise STE deployment program since 2007 as developers and suppliers have built up not just excellency in solar research, but also an entire STE industry representing the whole value chain.

Today, the STE sector differs fundamentally from solar PV especially in the sense that there is no STE power plant built today in the world that does not use technologies developed by Europeans or where European entities are encouraging innovation.

Amid the global competition for technologies and markets, this is not a minor aspect, and Europe should indeed be interested in defending this position.

Defending EU technology leadership in STE without a home market (STE plants built again in Europe) is an illusion.

[…]

The STE must expand (first in a EU “home market” and also on world markets) before the new entrants overrun European industries.

How quick and how large energy markets develop in EU (or in any other market of the world) depends on:

The idea that European STE technology can be defended without giving to the technology immediate local applications is much of an illusion: R&D (should) follow market needs /technology leadership cannot be engineered in labs without corresponding markets. This is especially true for STE taking into consideration the crucial objective of cost reduction, for which incremental innovations will be easier to introduce to STE markets without further negative impact on costs.

Finally, the STE success story that started for Europe in Spain (due to the optimal solar resources of the country and the shared vision of both right (2004) and left (2007) wing political parties) was put at threat by retroactive changes of the legal framework about renewables from 2012 on.

The key feature is manageability of STE generation together with a huge cost reduction potential that will make a further increase of variable RES into the power system possible and sustainable.

[…]

Solar Thermal Electricity (STE), also known as Concentrating/Concentrated Solar Power (CSP), is a technology that produces heat by using mirrors to concentrate sunlight into a linear or central receiver, which brings the solar energy to a heat transfer fluid. This heat can be stored for hours or used right away to generate electricity – usually with a steam turbine – or as process heat for industrial application.

Solar thermal electricity generated from plants with thermal storage system deliver firm electricity on demand without additional cost – even after sunset.

STE is grid-friendly not only due to thermal energy storage, but also due to the mechanical inertia provided to the grid by conventional turbines, since solar thermal power plants produce solar thermal electricity in a similar way to conventional power stations – based on absolutely reliable technology.

Five main elements are required: a concentrator, a receiver, a heat transfer fluid, a storage system, and power conversion block. Many different types of systems are possible, including combinations with other renewable and non-renewable technologies. So far, plants with both solar output and some gas or biomass co-firing have been favoured in the US, North Africa and Spain. Hybrid plants help produce a reliable peak-load supply, even on less sunny days.

The reason was a political decision in the aftermath of the financial crisis 2008 motivated by an apparent cost gap between STE and variable RES in times where no investor had to care for system adequacy.

[…]

While substantial STE investments occur on world markets using EU technology and combining advantages of all RES technologies case-by-case in response to local needs, EU stopped investing in STE.

This led to a situation where – just as for any other energy technology – the STE sector in Europe is today depending on a political commitment by some countries to create the necessary boundary conditions (i.e. legislative and financing instruments) for achieving the agreed targets. This will also provide again sufficient confidence to investors for taking higher entrepreneurial risks in Europe.

The retroactive measures fully destabilized the revenue stream of operators and investors, knowing that the total investment in Spain of 14Bn€ was held only to 65% by Spanish entities and 35% by foreign investors.

[…]

The measures were in detail:

Followed in 2012 and 2013 by

The impact of these retrospective measures on the Cash Flow and Debt Service of the projects was from last December to February 2013 already a 37% income reduction that was simply impossible to be covered by the projects.

Main financial figures of the STE sector in Spain

The reality behind the Spanish Electric Deficit

The Spanish government loses first ICSID arbitration claim over retroactive measures against Solar Thermal Electricity (STE) plants.

[…]

The retroactive measures taken against STE plants by the Spanish government in 2012 – 2013 and consolidated in 2014 resulting in a massive change of the remuneration scheme for RES power plants have now been unanimously condemned by ICSID, the International Center for the Settlement of Investment Disputes. Among the 26 arbitration claims against these changes filed at the ICSID by several RES industries, the case of the STE industry (20 claims) stands out since these measures brought the deployment of STE to a stop in Europe and still negatively impact the business development of European companies holding worldwide technology leadership in STE technology.

Well known is that right after the STE plants were built, the revenue streams of plant operators were suddenly cut by a third(!).

Less known is that ahead of these cuts, the solar thermal sector had reached an official agreement with the Spanish government so as to keep a stable remuneration for previously constructed or awarded plants. By this agreement, the STE sector accepted delaying both the operation start of the plants and the remuneration regime “pool + premium” by one year compared to the initially authorized schedule. This resulted in savings for the Spanish system of around 1.4 billion € already between 2011 and 2013. While the STE sector scrupulously fulfilled its commitments (and effectively refrained from a 1.4 billion € income), the Spanish government did not comply with its obligations.

The main argument used by the Spanish government to defend the changes was that “entrepreneurs should have known that laws can be changed”. Indeed, all entrepreneurs knew and still know it, but the ICSID now arbitrated that such massive sudden changes of agreed rules may not occur in whatever way. The Spanish Ministry recently said in a press release regarding the arbitration award of ICSID that each arbitration is “different”. No doubt about that. However, the common denominator of further arbitration awards about the solar thermal sector (with still some 20 pending cases) will lie now in two undisputable facts: a) the abrupt retroactivity of the measures taken and b) the obvious breach by the Spanish government of an agreement with an industry sector. In addition, the assessment of the damages performed in this first ICSID sentence shows that the current remuneration scheme that was set to provide a “reasonable profitability” on investments of 7.4% is a fiction that even the experts presented by the Ministry recognized.

The Spanish government might now take this arbitration award as a good opportunity to consider whether it makes sense to wait for an expected “string” of negative awards due to the fact that most of the still-pending cases are from the STE sector or to be proactive and negotiate with both international investors and the STE industry an acceptable settlement solution.

Recent reports in major Spanish media mention that the Spanish Ministry is now likely to lobby the EU institutions for avoiding the payment of the ICSID sentence (128 M€) via a) declaring its own RE support schemes as a breach to EU State-Aid rules and b) stating that the Energy Treaty Chart would not apply within EU Member States. Furthermore, ESTELA also observes obvious hesitations from the Spanish Ministry of Energy to support and even spearhead a “STE initiative for Europe” worked out with the SET-Plan framework aiming at defending the STE technology leadership position held by companies in about 10 EU Member States – amid fears that non-European competitors might easily take advantage of a longer STE investment stop in Europe.

It is expected that EU incentivizes Member States to create a credible European framework for a better use of natural resources across Europe towards a better ratio between variable and manageable renewables allowing to achieve the decarbonization of the power system by 2050.

[…]

A political commitment (via e.g. a political declaration by several MS backed by the EU services or under the SET-Plan) to enhance cooperation on concentrated solar thermal technologies for power generation, heating, including for industrial purposes, solar chemistry and desalination.

Such a declaration should be actively promoted especially (but of course not exclusively) among those Member States having a direct stake in the sector.

The main risk is that there will be no more business case for any renewable technology once a given penetration threshold of 30-40% of variable RES is achieved and the energy transition kicks back into fossil sources.

[…]

In Europe, the combined effects of:

Last, but not least, the unbalanced ratio between manageable and intermittent resources will trigger alarming effects.

The main reason is that a deployment of variable generation sources up to a level beyond approximatively 30 % already tables the issue of sustainability of the energy transition itself. Variable generation sources will inject into the grid energy at the same time without a corresponding market demand. This results in:

Market forces can only increase efficiency of actors towards a political goal, but will not deliver without solid regulation system value – and even less added value for society at large.

[…]

Prior to assessing the “business as usual” vectors of any energy policy discussion in Europe, namely:

It is urgent to assess the implications of further delayed or withheld action for the sector in terms of:

Policy makers are the only mandated forces in charge of energy policy choices taking into account all their implications.

Policy-makers should embrace in their strategy the 3 dimensions of the energy transition:

Soon will overcapacities in Europe decrease and call for replacing old power plants. This situation and the investments needed ahead of this put also decision-makers in front of their responsibilities to prepare the most important step towards energy transition.

[…]

Let’s take an example:

There are at least 9 Member States with companies holding references in STE technology and well positioned to compete on STE world markets.

[…]

It is indeed a matter of urgency to debunk the erroneous perception in many national authorities, ministries, regulators, European institutions’ services that the potential benefits of a relaunch of this sector would be limited to those European countries where STE power plants were already built and/or having very good solar resources (Portugal, Spain, Italy, Greece).

The reality is very different: as true it is that the main European STE promoters in Europe as of 2016 are based in Spain (such as ACS Cobra, Acciona, Abengoa, Sener, TSK, Elecnor, etc.), this is just the most obvious outcome of the STE deployment program launched in Spain in 2007-2013. But the industry texture of the STE sector is sub-stantially wider.

There are at least 9 Member States with companies holding references in STE technology:

The current developers of STE plants do best efforts on all active markets to aggregate companies from other European countries via joint ventures, alliances and EPC contracts. Even if the following list of companies is not exhaustive, entities such as in Denmark (Aalborg), in the Netherlands (NEM), in Belgium (CMI, Enseval-Moret), in Italy (Ansaldo, Archimede, ENEL Green Power, Turboden, CCI-Orton), in Germany (Siemens, MAN, BASF, Schlaich Bergermann, Flaveg), in the Czech Republic (DOOSAN Sköda Power), in France (GE(former Alstom), ENGIE, Saint-Gobain, CNIM, etc.), in Portugal (EDP Inovacao) can be mentioned.

Besides supplies and services that are normally provided at least cost by local companies of the country where a plant is built (civil works, assembling on site, non-specific auxiliary services) there is a widespread distribution of STE competences and business potential for companies across at least 9 EU member States.

These companies hold references in STE technology, based for a substantial part on own R&D and are able to successfully compete on global STE markets – if politically supported by fair competition conditions and based in an own home (means in this case: European) market.

The STE industry deploys dynamically at worldwide level. New markets are emerging on most world regions and countries with continents where the sun is strong and skies clear enough, including the U.S., China, India, Turkey, the Middle East, Latin America (including Mexico and Chile), Australia, North Africa and South Africa with ambitious and far-seeing development plans for STE.

The STE industry deploys dynamically at worldwide level. New markets are emerging on most world regions and countries with continents where the sun is strong and skies clear enough, including the U.S., China, India, Turkey, the Middle East, Latin America (including Mexico and Chile), Australia, North Africa and South Africa with ambitious and far-seeing development plans for STE.

A key point for the deployment of renewables in Morocco was the quality of policy and institutional framework about two targets – also recognized by all international financial institutions.

[…]

A key point for the deployment of renewables in Morocco was the quality of policy and institutional framework about two targets – also recognized by all international financial institutions.

The most striking element that makes Morocco stand out among all STE deploying countries is the quality of the policy and institutional framework elaborated there to achieve 2 targets:

A decisive move was the creation of MASEN (Morocco)

The NOOR STE projects have achieved very competitive tariffs, among others due to the project structure adopted by Masen.

All this produced within few years impressive results, with last but not least much better financing conditions offered by a very wide range of major international financial institutions for the implementation of Moroccan Solar Plan that the ones any EU country would be granted!

The first of the NOOR Ouarzazate STE projects and the first stage of Morocco’s Solar Plan, NOOR I (150 MW parabolic trough project with 3 hours of energy storage), is connected to the grid since end 2015.

The second phase of the Solar Plan comprised two CSP projects procured concurrently:

And a further 250 MW will be added to Moroccan’s energy system next year. Most important feature of the decision-making process in Morocco is the fact that the solar generation shall be balanced up to a considerable amount of STE recognizing by that the complementarity between both solar technologies.

The Middle East is ramping up its plans for STE based projects and is about building up capacities well in line with the IEA target figures for 2050 where STE should be the dominant technology in the MENA countries.

[…]

The Middle East is ramping up its plans for STE based projects and is about building up capacities well in line with the IEA target figures for 2050 where STE should be the dominant technology in the MENA countries.

[…]

China awarded a first batch of 20 STE projects in September 2016, including nine solar towers, seven parabolic trough plants and four Linear Fresnel plants. The projects must be completed by the end of 2018 to be eligible for the Feed-in-Tariff (FiT) of 1.15 yuan/kWh ($0.17/kWh).

[…]

Recently, a new actor entered STE markets – China with a very active involvement of stated-owned/supported Chinese companies in the sector in various regions of the world with good solar resources.

In China, developers must overcome limited build experience and China’s severe weather challenges to meet tight construction deadlines set out in the country’s first large-scale deployment program.

China awarded a first batch of 20 STE projects in September 2016, including nine solar towers, seven parabolic trough plants and four Linear Fresnel plants. The projects must be completed by the end of 2018 to be eligible for the Feed-in-Tariff (FiT) of 1.15 yuan/kWh ($0.17/kWh). This gave developers just over two years to secure financing, select an engineering, procurement and construction (EPC) contractor, and construct the plant.

A two-year timeframe may be sufficient in more mature STE markets, but not in markets such as China, especially as wintertime in northwest of China brings extremely low temperatures which can prevent civil work for several months. such as the Western regions of Qinghai and Yunnan that can be hit by sandstorms and temperatures which can swing from -40°C to 20°C in one day,

China currently has a successful track record in developing and nuclear, fossil fuel, hydropower, PV and wind power plants, but there is little experience in large-scale CSP construction.

The main challenge is the lack of experience in system design and integration. China has many demonstration loops and systems, but now the minimal capacity [in the pilot program] is 50 MW. Going from 1 MW to 50 MW and 100 MW will not be easy.

China’s operational STE plants are in Feb 2017:

EU policy should be aware that in order to shorten the learning curve and reduce project risks, local developers are now contracting experienced international STE consultants, such as:

Another major advantage for developers in China is the country’s comprehensive supply chain, requiring minimal imports. Major components such as parabolic trough receiver tubes (heat collecting elements), reflectors, raw glass, molten salt and thermal oil, can all be supplied and installed already at relatively low cost. SunCan is currently developing a 100 MW solar tower in Dunhuang, in the Gansu province and a technology supplier for two 100-MW solar tower projects in Jinta and Yunmen, Gansu province. The company is also the EPC contractor for a 50 MW parabolic trough project in Delingha, Qinghai province.

There is a risk for Europe that the market entrance of China into STE develops similarly like the PV panel dispute – linked to Chinas economy model (WTO case about “market economy”).

[…]

The industrial threat on Europe of the market entrance of China into the STE market is likely to follow a similar development like the PV panel dispute linked to Chinas economy model (WTO case about “market economy”).

The scenario is well known: it consists first in copying technology, then reproducing at lower costs, building up some project references via limited joint ventures with European companies and finally push European market actors out of their home and the world market via companies take-overs, mergers, etc.

The solar PV panel dispute has been by far the biggest trade controversy between the EU and China. Under the Climate and Energy Package 2020, the EU became the largest market for solar panel products, reflecting growing demand for renewable energy consumption.

China, meanwhile, has surpassed the EU as the largest solar panel manufacturer in the world. The lower prices of Chinese solar panels have encouraged installation of the solar system in EU Member States. A group of European manufacturers who felt marginalised by the pricing of Chinese exporters, however, lodged a petition to the European Commission against alleged unfair competition.

After an investigation, the EU imposed tariffs on solar panels imported from China, prompting the latter to immediately launch an anti-dumping probe on European wine. Since the EU is China’s biggest trading partner and China is the EU’s second partner, both parties decided to settle the dispute through negotiations instead of starting a trade war. In July 2013, the EU and China settled the solar panel dispute.

The main dispute was pricing. Chinese exports of solar panels enjoyed lower prices in the EU market, which, according to the EU solar industry, resulted from cheap loans and government subsidies. Following the introduction of the Five-Year Solar Plan by the Chinese government, the price of a Chinese solar module fell dramatically from 3€ per Watt peak (Wp) in 2008 to as low as 0.40€ per Wp in 2011.

Elsewhere, production costs of solar energy, a novel field, were also experiencing a market decline in production costs. Meanwhile, the manufacturing capacity of China’s solar-panel industry grew tenfold, and the surge in exports contributed to a 75% drop in world prices.

The agreement between EU and China consisted of a minimum price of EUR 0.56 per Wp for panels until the end of 2015 and of a limitation of the export volume. This did not change much to the takeover of the PV production by China.

[…]

In July 2013, a settlement was reached between the EU and China. The agreement consisted of a minimum price of EUR 0.56 per Wp for panels until the end of 2015 and of a limitation of the export volume. Chinese companies were also allowed to export to the EU up to 7 gigawatts per year of solar products without paying duties. About 90 per cent of Chinese solar manufacturers signed up to the minimum price. According to Karel De Gucht, the EU trade commissioner, the price undertaking would “stabilise the European solar panel market and remove the injury that the dumping practices have caused to the European industry”. The EU PV makers, however, felt that the settlement was “not a solution but a capitulation”, and that the “EU commission decided to sell the European solar industry to China “under pressure”.

Since the trade relationship between the EU and China is admittedly too big to fail, settling the solar panel dispute can be considered successful for having avoided a trade war. It is crucial for both the EU and China to maintain good trade relations based on mutual benefit. However, differing trade interests with China of Member States have divided the EU in the negotiations. In facing the increasing bargaining power of China, a joint effort among the EU Member States is advisable.

For the PV solar manufacturing industry, global competition has resulted in reduced prices. The lower solar panel prices bring benefit to the customers, as well as the Member States that are promoting the adoption of renewable energy consumption by subsiding the installation of solar panels.

This current price level for PV panel points also – taking of course the off-taker needs – at the possibility of new hybrid plants STE/PV that would combine the key assets of both technologies (example in Chile)

Unfortunately, not much… EU and China have indeed an interest in joining their efforts in international rule making and global standard setting bodies. EU will actively pursue global supervisory and regulatory solutions, promoting open markets and regulatory convergence, and build on co-operation with China.

[…]

Dialogue comes always first: The EU has a clear preference for resolving trade irritants with China through dialogue and negotiation. The existing EU-China trade related dialogues should be strengthened at all levels, their focus should be sharpened on facilitating trade and improving market access and their scope extended.

EU and China also have an interest in joining their efforts in international rule making and global standard setting bodies. The EU will actively pursue global supervisory and regulatory solutions, promoting open markets and regulatory convergence, and build on co-operation with China through EU-China regulatory dialogues. This will also help to ensure compliance of Chinese imports with EU standards for food and non-food products.

But where efforts fail, the Commission will use the WTO dispute settlement system to ensure compliance with multilaterally agreed rules and obligations.

Trade defence measures will remain an instrument to ensure fair conditions of trade. The EU is actively working with China with a view to creating the conditions which would permit early granting of market economy status (MES). Recent progress has been made on some of the conditions. The Commission will continue to work with the Chinese authorities through the mechanisms we have established and will be ready to act quickly once all the conditions are met.

Build a stronger relationship. A key objective of the negotiations for a new Partnership and Cooperation Agreement, which will also update the 1985 Trade and Co-operation Agreement, will be better access to the Chinese market for European exporters and investors, going beyond WTO commitments, better protection of intellectual property and mutual recognition of geographical indications.

On 12 May 2016, with an 83% overwhelming majority, the European Parliament passed a Resolution against dumping and the granting of MES to China. The Resolution is an important signal that the EU will not grant MES so long as China fails to meet its WTO obligations.

In December 2016, WTO will re-examine China’s terms of membership and decide whether or not to grant market economy status (MES)

Under Section 15 of the Chinese WTO Accession Protocol, China can be treated as a non-market economy (NME) in anti-dumping proceedings. The definition of China as a NME allows importing countries to use alternative methodologies for the determination of normal values, often leading to higher anti-dumping duties.

The correct interpretation of Section 15(d) of the Chinese WTO Accession Protocol has come under debate, as well as whether the latter section stipulates the automatic granting of Market Economy Status to China after December 2016. This analysis looks at the debate regarding the interpretation of Section 15(d) and the current policy of selected WTO members with respect to China’s Market Economy Status.

Efforts for setting up improved European R&D infrastructures in the sector should be seen today as crucial – because the EU wants indeed the European industry to maintain its global leadership in the sector. Otherwise know-how and knowledge bearers will be acquired at low cost by non-EU competitors.

[…]

In case of a prolonged stagnation of the STE deployment in Europe, the competitiveness and the recognized excellence of European research centres involved in STE research will be negatively impacted.

As of 2017, the distribution of STE dedicated R&D facilities is as follows:

Laboratories working for STE research are distributed as follows:

In spite of having these R&D infrastructures managed under different national governance and funding schemes, they all are structurally depending on direct relations with the STE industry. Furthermore, the European Commission supports financially R&D projects under H2020 including the improvement of cooperation across these centres up to the potential setup of common research infrastructures for the sector.

Maintaining Europe without an own STE deployment program will question the need for and the further use of non-industry R&D facilities.

This will result in an attractive opportunity for non-European competitors to acquire knowledge bearers at low cost on labour markets.

Technology will also be acquired at the lowest costs in case of company takeovers.

It is just a matter of time until the absence of a European STE market severely impacts the mere existence of these knowledge and innovation centres.

Furthermore, the short-term priorities of R&D centres (all working under essentially national R&D plans and governance models) are sometimes far away of what industry considers as most promising technology. The STE industry calls for a better coordinated governance for the use of European R&D resources regarding existing and new R&D infrastructures as presented in the EU-Solaris project (2012-2016) and STAGE-STE project (2015-2018) acting as a bridge between research institutions and STE industry and gathering hundreds of high-level scientists and experts contributed to define several action lines along the entire value chain of the sector (material, performance optimization of components, etc.).

In the STAGE-STE project, STE research entities and industry have jointly delivered substantial input to the “Initiative for Global Leadership in Concentrated Solar Power (CSP) / Solar Thermal Electricity (STE)” that was recently approved by the SET-Plan. The practical implementation of this Initiative will soon bind in a coherent process across Member States several important research projects anticipated by STAGE-STE and already evaluated by the industry as most likely to bring a competitive / innovative advantage with the realisation of a First-of-A-Kind (FOAK) commercial project in STE in Europe.

As a closing conference, STAGE-STE will present the main projects results in the wider perspective of the current situation of the CSP/STE sector in Europe and the expected developments. This event will be organised on the 23rd January 2018 at the European Economic and Social Committee (EESC) in Brussels. The event will address:

To view programme and register to the event, please visit here: http://stage-ste.eu/workshop/

RES has already increased their share from 26% of total power capacity in 2005 to 47% in 2017. By 2017, the total RES capacity installed in the EU was 455 GW, 169 GW was in wind and 107 GW in PV, both accounting for 29.5% of the EU power mix.

[…]

As far as the EU power system is concerned, the energy transition to RES is today consistently seen an irreversible process. It evolved from a timid policy-driven process to a mainstream investment that will have substantial impact on the economy of the next decades. Europe is certainly going for green growth.

[…]

Electricity generation from intermittent RE sources (wind, PV) fluctuate over time due to the varying availability of wind and sunshine. This poses a challenge to the power system. Even improved operations and system-friendly intermittent deployment practices might be insufficient to manage high shares of VRE in the long term. Also, the variability of intermittent generation and other adverse effects can lead to a drop in system value.

[…]

The increasing share of variable renewable generation is fostering policy makers and regulators to reconsider power market designs and system planning and operation. The more installed capacity in intermittent generation, the higher the probability to face such an imbalance between supply and demand. For covering the afternoon-evening peak, the penetration of intermittent generation in such systems needs to be backed by fossil-fuel plants – with a large share of combined cycles.

In short, policy makers, regulators and power system operators around the world must adjust and ensure no interruption to the continuous transition to renewable systems while promoting the growth in variable renewable power. It is essential to pursue an efficient combination of measures.

[…]

This has three concomitant effects:

[1] Source: http://aip.scitation.org/doi/abs/10.1063/1.4949251

It is because that RES in general is often not seen as a tool for its own system integration. Policy priorities during the early days of VRE (wind, PV) deployment were simply not focused on system integration. Instead, past priorities could be summarised as maximising deployment as quickly as possible and reducing the LCOE as rapidly as possible. However, this approach is not sufficient at higher shares of VRE. Innovative approaches are needed to trigger advanced deployment and unlock the contribution of manageable VRE technology to facilitating its own integration.

It is because mechanisms are needed to provide sufficient long-term revenue certainty to investors calculating the precise system value can be challenging and the current and future SV will differ.

[…]

[1] System value (SV) is defined as the net benefit arising from the addition of a given power generation technology, a look beyond costs/LCOE.

[2] http://www.iea.org/publications/freepublications/publication/Next_Generation_Windand_Solar_PowerFrom_Cost_to_ValueFull_Report.pdf

[…]

Spain: http://www.solarpaces.org/wp-content/uploads/protermo_solar_21x21_inglesc.pdf

According to the Alianza por la investigación y la Inovación Energéticas (ALINNE) in 2015, STE plants are the ones creating more jobs since their construction to their start in operation. Each 50 MW plant employs an average of 10,000 persons/equivalent/year during all the stages (from design, to component manufacturing and installation), half of these jobs are direct and half indirect. Furthermore, each 50 MW plant built in Spain employs 2300 persons/year on manufacturing of components and construction on-site during the two years of construction. Once in operation, they require 50 permanent jobs. Indeed, local economic development (i.e. the local content of STE plants and their contribution to GDP) remains one of the main drivers behind the supporting policies in many countries of the sun belt.

[…]

According to the Alianza por la investigación y la Inovación Energéticas (ALINNE) in 2015, STE plants are the ones creating more jobs since their construction to their start in operation. Each 50 MW plant employs an average of 10,000 persons/equivalent/year during all the stages (from design, to component manufacturing and installation), half of these jobs are direct and half indirect. Furthermore, each 50 MW plant built in Spain employs 2300 persons/year on manufacturing of components and construction on-site during the two years of construction. Once in operation, they require 50 permanent jobs. Indeed, local economic development (i.e. the local content of STE plants and their contribution to GDP) remains one of the main drivers behind the supporting policies in many countries of the sun belt.

Drivers for STE cost reduction are:

[…]

Some of the soft cost categories (e.g. environmental assessment of large plant development) are applicable to both PV and CSP. However, overall CSP costs remain more dominated by hard costs than are PV installations.

[1] Link to this report: http://www.irena.org/documentdownloads/publications/irena_rethinking_energy_2017.pdf

Barriers for STE deployment in Europe:

[…]

According to ESTELA, this cost reduction trend necessarily requires a minimum volume of projects, which has been estimated at some 30 GW worldwide by 2025. The first threshold of 10-12 €/kWh will be achieved through lower cost solar collectors and construction techniques; while 8-10 €/kWh will be the result of reaching higher temperature system and mass production. Central receiver plants can certainly be supportive to this process.

The recent STE deployment in active markets, such as Morocco, Chile and South Africa, showed in the last 2 years how fast the STE costs can be reduced in terms of maturity and financial support:

[…]

A fundamental objective of any green growth programmes is about energy and industrialisation objectives trying to maximize positive macroeconomic impacts in the country’s or the region’s economy…

The first objective for policy-makers remains to unlock the investment needed to achieve a transition to “green growth”.

However, governments face significant challenges in securing the level of investment needed due to real and perceived investment risks, insufficient returns on investment for some green technologies and practices, competing subsidies and policies, insufficient capacity, information gaps, competing development priorities and other adoption, and regulatory and institutional barriers.

Government financing strategies for green growth should therefore seek to encourage green investment opportunities by combining effective use of government policy and funding arrangements with financial risk mitigation instruments.

Governments are supposed to decide on energy policies that address investment needs for the transformation of the whole economy and in specific priority sectors at both national and regional levels. The role of governments is absolutely prominent in the early stages of any green market development or relaunch so to unlock substantial pools of private capital and defining from the outset a clear exit or diminished role over time.

Governments can play three primary roles in mobilizing green growth investment:

Governments have the greatest success with public finance measures which are integrated if possible, with other national development programs, developed in consultation with the business and finance communities, and tailored to address local investment risks and market constraints.

TSOs have no responsibility for system adequacy, i.e. that there is enough capacity on the market to allow them to do their job properly. The TSO role about system adequacy is a role of whistle blowers, no more.

Modify the type and volumes of electricity generation in a system is essentially a matter of investors

TSO do have and will keep supra national and supra regional operational responsibility (i.e. the task of real-time balancing generation and demand) in power systems. In their role of managing the increase amounts of intermittent generation sources, TSOs will no doubt need to better cooperate with DSOs and new agents (independent power producers, “prosumers”, etc.).

But political authorities bear in fact the responsibility for the adequacy of the system and the policy framework they provide to markets should be highly efficient to correct shortcomings of strategies considering electricity just as a commodity.

The political decision-makers should be aware of the need for a long-term planning strategy that should include the sooner or later unavoidable dismanteling of conventional generation that is today taking up most of the system back-up.

This may soon put the whole energy transition at threat instead of supporting it. Why?

In both cases,